Financing Survival Guide for Heavy Civil and Marine Contractors

View the complete article here.

Whether you’re pile driving, drilling, dredging–or whatever service you offer–it’s going to cost you time, manpower, equipment, and materials. As most of you already know, none of these come cheap, especially these days with material and labor shortages, as well as a likely recession on the horizon.

What can you do about it?

The good news is that there are many options available for financing that equipment you need for the job. In this article, we’re going to break down exactly what these options are and how they can benefit you.

Recession Concerns

It’s clear that a recession is likely to happen in the near future, and some may argue that the wheels are already in motion–that we’re already in the early stages of one.

What is a recession?

According to Forbes, “a recession is a significant decline in economic activity that lasts for months or even years. Experts declare a recession when a nation’s economy experiences negative gross domestic product (GDP), rising levels of unemployment, falling retail sales, and contracting measures of income and manufacturing for an extended period of time. Recessions are considered an unavoidable part of the business cycle—or the regular cadence of expansion and contraction that occurs in a nation’s economy.”

In other words, people lose work, businesses make fewer sales, and the economy struggles.

What triggers a recession? Recessions are typically caused by excessive debt and/or too much inflation.

How long does a recession last? According to the National Bureau of Economic Research, from 1945 to 2009, the average recession lasted 11 months.

Although it’s almost impossible to predict a recession or economic downturn of any kind, understanding the financing options available is crucial for success as a contractor.

Reasons to Finance

Whether our country is officially in a recession or not, having capital–and even “cold hard cash”–available is one of the simplest and most effective ways to protect you and your construction business. For that reason, financing equipment is an excellent way to keep funds handy for rainy days or even just the basic operating and overhead costs.

Other reasons to finance your construction equipment includes:

- Capital conservation: When capital is preserved by financing or leasing equipment, it can be used for other necessities like payroll and materials.

- Flexibility: Unlike other types of financing in other industries, heavy equipment financing tends to be flexible and can be customized for specific business needs.

- No need for additional collateral: Most term loans require you to provide collateral that you already own, such as a vehicle. However, this typically isn’t the case with an equipment loan. Generally, heavy equipment lenders are satisfied with using the equipment being purchased as collateral.

- Business cycle consideration: There are leasing options available that benefit seasonal businesses. These benefits may include a lower monthly payment during the “off season” while projects are not active and revenue is low.

- Equipment expertise: Some heavy lenders have close relationships with equipment distributors and manufacturers–and are even equipment experts themselves. This is a great opportunity to get a second opinion before you pull the trigger on a pricey rig.

Financing FAQs

Is this your first time acquiring financing for heavy equipment? Even if you’ve done it before, we would recommend considering these questions before you take action:

- Can I get a heavy equipment loan with poor credit? Yes. Many lenders do not require excellent credit if you can provide proof of solid revenue.

- Can I obtain heavy equipment financing from a bank? Yes. Even some of the smaller banks offer loans for heavy equipment. However, most banks are pretty strict when it comes to credit scores and proof of revenue.

- What exactly do I need to qualify? As mentioned before, qualifying for a heavy equipment loan is generally easier compared to other business loans, because the equipment being purchased is used as collateral.

- What is considered a “good” credit score? Generally scores ranging from 580-669 are considered “fair”–670-739 are considered “good”–740-799 are considered “very good”–and 800+ are considered “excellent”.

- What are the typical interest rates for a heavy equipment loan? Interest rates are generally based on your credit score and business revenue, as well as the type of equipment and its condition. Depending on the lender, the average rate ranges between 7.5%-28%.

- How long does it take to get a heavy equipment loan? While banks tend to take weeks–even months–most financing companies usually provide the money within weeks–and even days–in some cases.

Alternative Finance Companies

Looking for alternatives to large lenders and banks? We don’t blame you. Although there are some advantages to using banks, alternative finance companies are becoming more-and-more popular for reasons including more attention and personalized relationships, as well as greater leniency with credit scores and business revenue.

One of these alternative finance companies is NEXUS Commercial Finance. Lenders like NEXUS get creative and want to help the smaller and mid-sized contractors, which is why we sat down with them to help explain all of the options available to contractors right now.

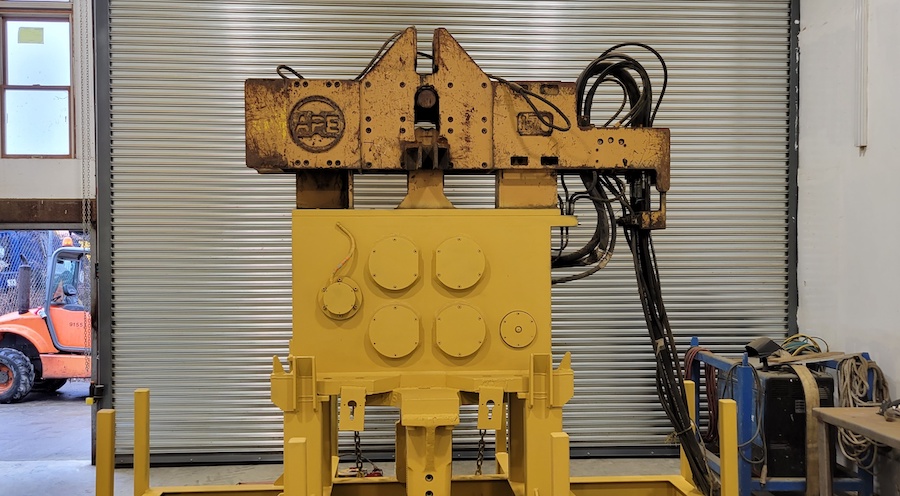

Leasing Equipment

Leasing a pile hammer or excavator may make sense for deep foundations and marine contractors who are feeling unsure of the market – or future contracts. In some cases, there are tax advantages to leasing over buying. We recommend talking it over with your accountant.

Leasing a piece of equipment means renting it over an extended period of time. (Unlike renting equipment for a day from your local home improvement store.) At the end of the lease period, you either return the equipment or renew the lease contract. You may also have the option to buy the equipment, known as “lease-to-own.” Lease-to-own gives contractors the opportunity to use the equipment before they commit to buying it.

Sales-Leaseback

For contractors who are equipment rich and cash poor, sales leaseback may be the answer to your capital needs prayers. Alternative financing companies like NEXUS will buy equipment you own outright then lease it back to you. Some construction companies use this type of financing to raise money during a recession when credit is particularly tight.

Let’s say you have a spud barge with a current market value of $500,000. You would sell it to a financing company for a lump sum of cash. They would lease it back to you for some period of time. Now you are in an equipment lease. The only difference is that you were the one who owned the equipment to start with. At the end of the lease you can just return the equipment or renew the lease. If you’ve set the contract up as a lease-to-own, you will own the spud barge again at the end of the lease term.

Custom Sales-Leaseback Contract

There are several variables to consider in a leaseback contract – there isn’t a “standard” contract in most situations. The lump sum you receive for the equipment is typically 50-100% of its current market value. The length of the contract, lease-to-own terms, and type of lease (operating or capital) are all negotiable. A capital lease shows up as a loan on your books; an operating lease does not. You may structure a capital lease so that you own the equipment again after the lease term. As you can see, the different options can get complex. You do want to have your lawyer review the contract before you sign.

Used Equipment Financing

Buying used equipment can lower costs and allow a contractor to submit more competitive bids. NEXUS advises that they will consider financing used equipment. Each scenario is different – obviously it depends on the type, age, and condition of the equipment.

Once you identify the used equipment you want to buy, provide the information to the lender for review. It is typically easier to finance equipment that is under 10 years old. You may also be able to finance a group of construction equipment. The criteria that impacts the interest rate for a used equipment loan include your personal credit and the age / condition of the equipment. How long you have been in business and annual revenue are also considered.

Accounts Receivable Financing

NEXUS will allow you to borrow against your accounts receivable. Typically, you can borrow at least 80% of the value of your outstanding invoices. In this type of financing, the lender is more interested in your customers. How likely are they to pay? How long will it take for them to pay? Again, it’s an assessment of risk – and the interest rate will reflect that.

You must submit your construction company’s outstanding invoices and other requested documents to the lender. Based on factors such as the type of industry in which you do business and the credit-worthiness of your customers, the lender gives you a percentage of the value of your accounts receivable in a lump sum. For example, if you have $100K in invoices, they may lend you $80K – or 80%. The lender charges you a fee, typically weekly, until your customer pays the invoice directly to them. The remaining 20%, or $20K, of invoices will be paid to you, less the lender’s fees.

Blanket Equipment Loan

A blanket equipment loan is a way to consolidate loans for equipment that qualifies for re-finance. This typically helps contractors lower their monthly payments. For example, you may have purchased a new crane, then a used barge, and then a new pile driving rig. You financed each one and are making three separate payments each month. You can consolidate the three loans under one blanket equipment loan.

A lender will review all or some of your outstanding equipment loans and allow you to borrow enough money to pay them off. You will need to show that you have been paying those loans consistently and on time. Note that the lender will pay off the outstanding loans. You now have one loan. It only makes sense if the new loan substantially lowers your monthly payment. The lender may do this by offering a lower interest rate and / or a longer loan term.

Pre-Approvals

NEXUS advises that small contractors can apply for pre-approval as a way to determine costs before (or during) the bidding process. Of course, you want pre-approval to make sure you can obtain financing should you win the bid.

Interest Rates

Don’t assume that alternative financing companies like NEXUS will always charge higher interest rates. It’s true that rates will be higher in some of the more creative financing scenarios. Higher risk – higher rates. But not always. It is worth talking to an alternative lender – even if you can qualify for a traditional loan. NEXUS advises that although clients often turn to them after they’ve been denied a traditional loan, they may be able to offer low-risk borrowers similar rates to banks. It’s always good business to consider all of your financing options.

Financing Growth

NEXUS tells us that alternative financing is becoming popular for those construction companies who are growing quickly. Newer companies (less than 3 years old) that have very high growth will typically have cash flow issues because they are hiring new employees, expanding their offices, and taking on more projects. They often have immediate capital needs that traditional lenders can’t (or won’t) provide.

Working Capital

NEXUS and other alternative financing companies can offer customized financing for working capital. You’ll need to hire employees, cover overhead expenses, etc. as you’re building your construction company. In some cases, having cash available allows you to advance payment to a vendor for a substantial discount. Borrowing money for cash discounts makes sense only when the savings are substantial enough to exceed the borrowing costs.

Start-Up Financing

Getting financing for a marine or deep foundations construction startup company is challenging. For some, if Aunt Minnie doesn’t agree to cough up some cash, their entrepreneurial dreams are dashed. Alternative financing companies like NEXUS will consider funding your startup. You still need a solid business plan. Yes, rates will definitely be higher for a startup. But you’ll be free from Aunt Minnie’s unwanted business advice.

Have any additional questions? Give NEXUS a call at 408-451-3993.

View the complete article here.

What is the importance of financing in deep foundations and marine construction?

Financing plays a crucial role in deep foundations and marine construction, as these projects typically require significant investments. This includes the cost of labor, materials, machinery, and other resources. Proper financing ensures that these expenses are covered, reducing financial risks and enabling the smooth execution of projects.

What strategies can be employed for effective financing?

Effective financing strategies may include seeking loans from financial institutions, exploring grant opportunities, negotiating favorable payment terms with suppliers, and maintaining a well-managed cash flow. Contractors should also consider equipment leasing or renting as cost-effective alternatives to purchasing.